Last week, Malaysia’s Central Bank (Bank Negara Malaysia) announced a six-month moratorium on loans to alleviate the financial burden of the rakyat. But what does that actually mean and does it affect you?

First of all, what is a MORATORIUM?

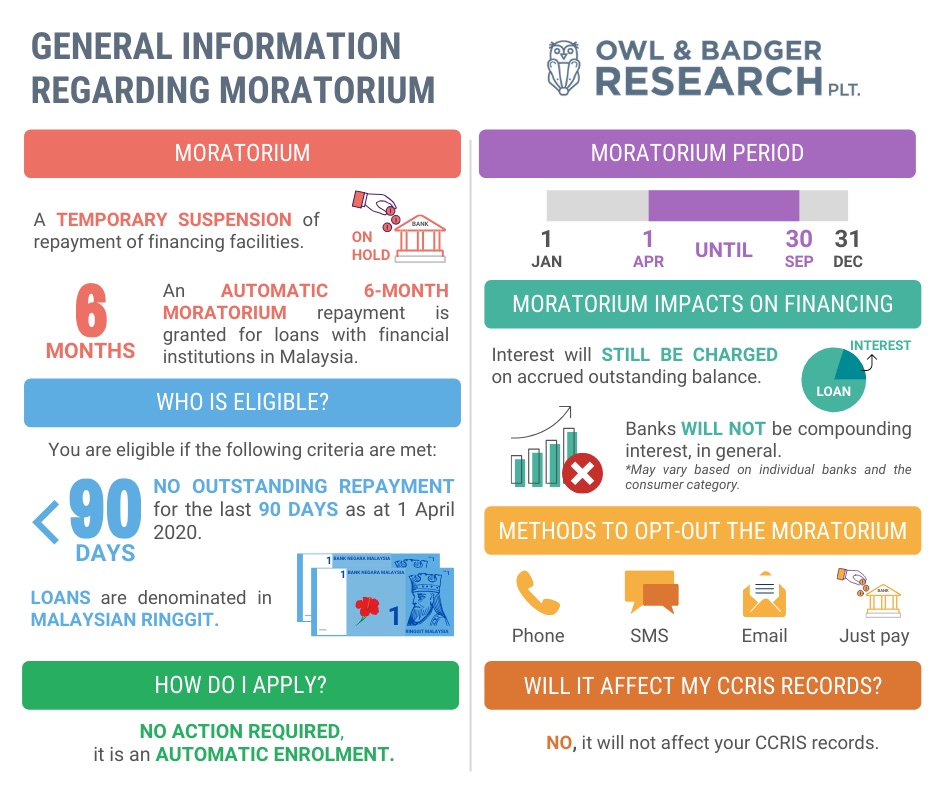

Moratorium means “temporary suspension” or more accurately in this context, a temporary suspension of repayment of financing facilities. In other words if you have loans or financing with banks or financial institutions in Malaysia, you

will be granted an automatic 6-month moratorium on your repayment.

Am I eligible for the AUTOMATIC MORATORIUM?

You are eligible only if your loan or financing is:

- not more than 90 days in arrears as at 1st April 2020 arrears = overdue, which means that you have not missed any payment from 1st January 2020 or earlier

- denominated in Ringgit Malaysia

How do I apply for it?

There is no need to apply and no action required on your part as it is an automatic enrolment.

What if I want to continue paying my loans as per usual?

You may Opt-Out from the Program by one of the following methods:

(some banks have Opt-Out dateline, please check with your respective banks)

- SMS (in most cases, an SMS will be sent by your Bank asking if you want to opt-out.)

- Continue Payment as Normal (optional for some banks)

- Email / Websites

- Phone Call to respective Banks

When will it start and end?

If you have repayment for loans or financing due from the 1st April 2020 – 30th September 2020, it will be deferred AUTOMATICALLY under the MORATORIUM.

Will this affect my CCRIS records?

NO. There will be no impact to your CCRIS (Central Credit Reference Information System) records.

How will this impact my payment?

Interest or Profit (for Islamic financing) will continue to be charged on the balance outstanding and accrued. Payment for the accrued interest or profit will have to be made in the future. In general, banks will NOT be compounding interest, although this will differ depending on individual banks and the type of consumer, whether your are an individual or an SME.

With many economic uncertainties now and in the future, a moratorium on loans and similar financing might help to ease financial commitments. Certain banks might also offer financing options that is unique to the bank so do not hesitate to call your local bank to find out.

Owl & Badger Research is an independent research company based in Sarawak, Malaysian Borneo